Small Business Tip: How Identity Verification Can Safeguard Your Business and Build Trust

ByJulian Gette

Workast publisher

Workast publisher

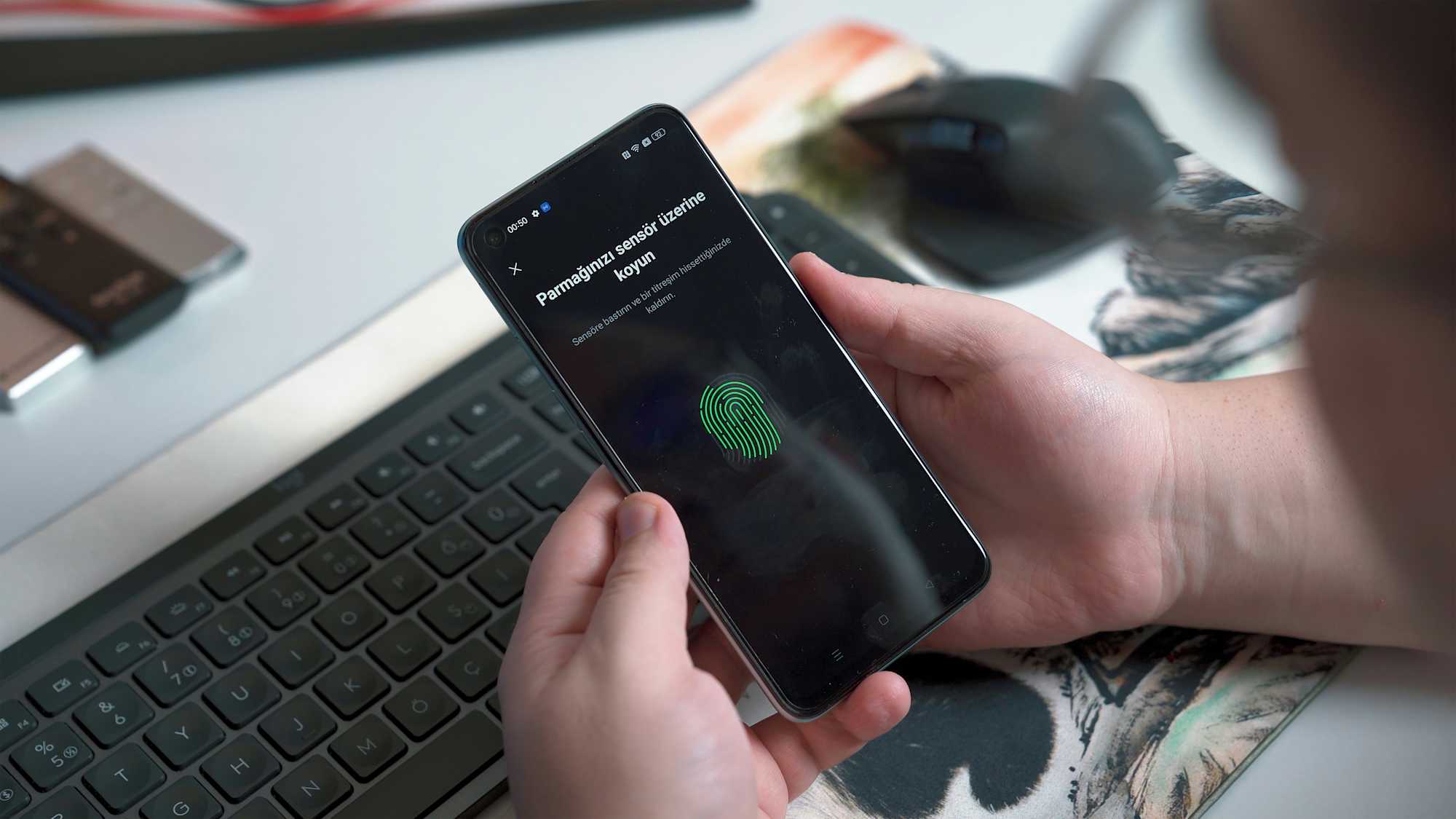

In today's fast-paced digital world, even small businesses face security challenges once reserved for larger corporations. From safeguarding customer information to avoiding fraud, every small business owner knows that maintaining a secure environment is key to sustaining customer trust and business growth. One often-overlooked but essential tool in the fight against digital threats is identity verification. For small businesses, integrating identity verification solutions can help protect your company, enhance customer experience, and strengthen your reputation.

Why is Identity Verification Important for Small Businesses?

Identity verification is not just for major banks or online retailers; it’s a security measure with significant benefits for businesses of any size. In a digital environment where fraud and data breaches are rising, small businesses often lack the resources to handle such issues when they occur. Here’s why identity verification should be part of your security strategy:

Prevents Fraud and Enhances Security

For small businesses, online transactions and digital customer interactions are increasingly common. However, as customer interactions move online, so does the risk of fraud. Fraudulent transactions and identity theft can lead to financial losses, harm your business’s reputation, and erode customer trust. Identity verification tools allow you to verify that each user is who they claim to be, reducing the risk of fraud and adding a layer of security that deters potential threats.

Strengthens Compliance with Regulations

Many regions have strict data privacy regulations to protect customer data and prevent identity theft. Laws like the GDPR in Europe and similar data protection laws globally require companies to verify and secure customer identities, especially when handling sensitive information. By using identity verification solutions, small businesses can better ensure they’re in line with regulations, helping avoid costly fines and penalties.

Builds Trust and Improves Customer Relationships

Customers today are more aware of digital security and often choose companies that take measures to protect their data. By integrating identity verification, you communicate to customers that you take their privacy and security seriously. This can improve customer loyalty, as they feel confident that they are transacting with a legitimate and trustworthy business.

Implementing Identity Verification: Steps for Small Businesses

So, how can small businesses implement identity verification effectively? Here’s a step-by-step approach:

1. Choose the Right Identity Verification Solution

Selecting the right provider is key. For small businesses, a solution that is both user-friendly and cost-effective is ideal. For instance, some platforms, like iDenfy, specialize in providing efficient identity verification services that cater to businesses of all sizes. Look for solutions that integrate seamlessly with your existing systems and provide robust verification capabilities to keep customer data safe.

2. Start with Customer Accounts and Payment Processes

If your business handles online transactions, implementing identity verification for account creation and payment processes is a good starting point. Verifying users during sign-up or checkout can prevent unauthorized access to accounts and reduce fraudulent transactions. This step protects both your business and your customers, promoting a safer, more trustworthy environment.

3. Educate Your Customers About Identity Verification

Customers may initially be unfamiliar or uncomfortable with additional verification steps. Be transparent and explain the process and why it’s beneficial for them. Clarify that it’s a security measure to protect their data and ensure a secure experience on your platform. By educating customers, you can build understanding and trust, helping them see identity verification as a feature rather than a hindrance.

4. Maintain Compliance and Stay Updated

Data security regulations are frequently updated. Keeping up with compliance changes is vital for any small business operating in the digital space. Regularly review your identity verification process and ensure it aligns with the latest legal requirements. This diligence protects your business from potential fines and penalties, safeguarding your reputation.

The Business Benefits of Identity Verification

Investing in identity verification offers tangible benefits beyond security. Here’s how adopting this measure can contribute to your business's growth and stability:

Enhanced Security with Minimal Effort: Identity verification providers like iDenfy handle the technical aspects, allowing your business to focus on operations without worrying about fraud or unauthorized access.

Improved Customer Experience: By offering a secure, trustworthy platform, you enhance customer experience, as customers feel safe conducting transactions or sharing data with your business.

Lower Operational Costs: Reducing fraud and chargebacks through effective identity verification saves money in the long run. Though there may be an initial cost, the potential losses from fraud and fines far outweigh these upfront expenses.

Identity Verification: An Investment in Your Business’s Future

In a digital world where cyber threats are increasingly sophisticated, safeguarding your small business should be a priority. Implementing an identity verification system isn’t just about compliance or avoiding fraud; it’s about building a foundation of trust, strengthening your business’s reputation, and showing customers that you value their safety.

With the right approach, your business can create a secure environment that benefits both you and your customers.